Individual bankruptcy is created to give debtors a new start off and supply reduction from creditors. But filing for personal bankruptcy is a posh choice, and whilst it would be the best route for some, it’s not ideal For each and every problem.

Applying for a credit card could be a successful way to start rebuilding your credit after a personal bankruptcy, but you should wait right until your bankruptcy is thoroughly discharged to apply. Based on the form of bankruptcy submitted, it could get providing five years for it to generally be discharged. There are lots of credit card choices accessible to people today article-individual bankruptcy, although quite a few are going to be secured cards that require a deposit to ascertain your line of credit.

So, keeping your balances minimal will go a long way in developing the credit utilization part of your credit rating (2nd only to on-time payments in significance). Additionally, it's going to save you dollars in desire in the event you don’t have a stability.

Calendar 10 Years of editorial practical experience Aylea Wilkins has long been at Bankrate due to the fact 2019, enhancing content material in college student, personal and home equity financial loans and auto, house and existence insurance policies before taking over editing material in a variety of other groups.

Breaking particular poor behavior is very important to creating quite possibly the most of your respective credit cards and avoiding detrimental your money wellbeing.

The answer to this question is determined by what exemptions you’re equipped to claim. If you are not in an decide-out condition, chances are high the income you have on you is roofed you could check here through the 13,950federal wildcard exemption. In the event you’re not using federal bankruptcy exemptions, you’ll want to examine your point out exemptions.

Credit card debt consolidation allows people get back economical balance by simplifying their personal debt payments, lowering interest charges, and in the long run attaining debt independence. Take a look at our picks for the top-rated financial debt consolidation organizations that may help you get article source control of your economic potential.

Understand that the degree of monetary reduction you get from bankruptcy will rely mostly on the sort of financial debt you’re saddled with. Bankruptcy received’t discharge little one support credit card debt, most back taxes or other financial debt ensuing from lawful obligations.

The suggests exam will work by comparing your profits towards your residence costs. When you have cash remaining in excess of, known as "disposable earnings," and fall short the signifies test, your best option might be to file a Chapter 13 case alternatively.

Receive strategies and tactics each month to boost Check This Out your finances. Enroll in our regular monthly e-newsletter.

You'll be able to keep some assets. Personal bankruptcy may involve useful reference you to provide some assets to pay off your debts. However , you received’t shed almost everything, since personal bankruptcy exemption legislation protect your property, vehicle, clothes along with other valuables up towards the greenback amounts stated below.

Scoring products like FICO and VantageScore take into account personal bankruptcy a very seriously unfavorable celebration. If a personal bankruptcy is added in your credit report, it could severely influence your credit rating.

Retain receipts. Like that, you could show the trustee what you purchased. This is especially essential if you’re spending greater than $fifty in any Source specified retail store.

Consider the situation underneath wherein the borrower has a higher-curiosity auto financial loan and two credit card balances that have been slapped with elevated interest rates due to missed payments:

Seth Green Then & Now!

Seth Green Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Burke Ramsey Then & Now!

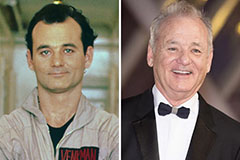

Burke Ramsey Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!